- Viewpoints

- Posts

- Six Shifts Shaping 2026

Six Shifts Shaping 2026

Themes We are Watching and Investing in This Year & Beyond

We’ve said it before and we’ll say it again… but with fresh eyes for 2026.

As Amara's Law reminds us, human nature tends to overestimate the impact of technology in the short term but underestimate it in the long term. The constant buzz of fleeting tech trends will come and go. But at FOV Ventures we’ve been persistently focused on a set of truly transformative technologies that have been unfolding gradually and are now converging to take us into a new era of computing.

Areas like AI, robotics, and spatial computing - that to many seemed like science fiction just a few years ago - are simultaneously reaching maturity and creating huge new opportunities. This is something we went even deeper on last year, publishing our first physical book on the subject (grab your free digital copy here)

While some of our focus areas have been steady companions for years, evolving in expected ways, others have accelerated dramatically. Physical AI and robotics, for example, have shifted from theoretical possibilities to practical realities. And other building blocks - from AI and computer vision to mixed reality and edge computing - are finally clicking into place.

The rapidly shrinking gap between digital and physical realms has long been our investment thesis and in 2026, the signals are even stronger.

We've moved from the "wow" phase of seeing a robot walk, to the "how" phase of making it an industrial-grade reality. The "frontier" tech of yesterday is becoming the infrastructure of today, and whilst some areas race ahead with major leaps seemingly arriving weekly rather than yearly - other areas are recalibrating and moving further away from the headline hunting hype machine of today’s tech industry.

So let’s revisit some of the key themes from last year and look at how they’ve evolved, the nuance we’re seeing on the ground, and how we might be allocating our capital this year.

If you are working on a startup, or investing yourself across any of these themes we would love to hear from you! Reach out on LinkedIn and submit details here

1. Smart Glasses: the most human interface for AI

Last year we predicted: Smart glasses would emerge as "the most human interface for AI."

What happened: We were right about the trajectory, but the winning insight was simpler than expected - smart glasses aren't just "phones for your face." They're "eyes for your AI." The value today is the AI's ability to see your life and provide proactive utility.

We made new investments in this category in 2025 and will continue proactively looking for opportunities. It remains early in the cycle, so we're interested in B2B opportunities while asking when and how main players will open to 3rd party developers - and what enablers still need building.

As Meta's CTO Andrew Bosworth noted, the form-factor's AI capabilities proved key in driving consumer adoption of this new wearable category. Ray-Bans validated the core assumption - people will buy tech-enabled sunglasses - de-risking the path to Meta's north star: Project Orion (full AR glasses).

Orion AI glasses: The future of AR glasses technology | Meta

A decade in the making, recent groundbreaking innovations from Meta with Orion redefine what is possible for AR, AI and beyond.

www.meta.com/en-gb/emerging-tech/orion/?srsltid=AfmBOoqS2_QvQ44zOZ4wzGVuzhq3gj7I421_cB79QnHNNGxoSc4yQmXL

They took a key step in 2025 with Meta Rayban Displays, which adds wrist-powered control and a subtle heads-up layer to everyday vision - surfacing photos, messages, and AI prompts without breaking eye contact with the real world.

Google - having announced AndroidXR and partnerships with Xreal, Warby Parker, Gentle Monster, and Samsung, plus impressing with Gemini's multimodal and memory capabilities - will be a key player in 2026. While CES witnessed a "war of hundreds of smart glasses," the other key players we're watching are Snap (next-gen Spectacles) and Apple (most likely 2027).

But as the category matures, what can startups build that Meta, Samsung, and Apple can't…

Innovation is still needed at the infrastructure level from startups that walk the fine line between true technical innovation, large customer demands, and commercial potential (e.g., WaveOptics sold to Snap for $500M).

A growing list of startups have clearly defined wedges - something in either hardware or OS that makes them competitive as AR/AI wearable emerges for mass consumers. Metra is building an open-source operating system for glasses. Raven focuses on eye-tracking HUD.

At the application level, the opportunity remains nascent and undefined, especially in consumer. We're watching closely while looking at opportunities in environments where users are paid to wear glasses and specialised AI assistants provide workers with productivity, safety, or decision-making boosts.

Our own investment, Spogen, leverages smart glasses + augmented intelligence for operators of heavy machinery. Startups like Syn2Core develop AI co-pilots for frontline automotive workers to minimise human errors. Many opportunities will emerge.

The 2026 Outlook: Infrastructure and vertical B2B applications are where startups can win. Consumer apps remain undefined but the opportunity space is large.

2. Voice AI: more interactions beyond the chat window

Last year we predicted: Voice would help AI break free from the 2D chat window, with LLMs entering the physical world through ambient interfaces.

What happened: We were right about voice emerging as a key interaction layer for both on-device and wearable AI, confirming the chat window isn't the be-all and end-all. For investors, it became a huge category in its own right - startups tackling everything from new wearables and vertical applications to the more critical infrastructure and tooling (like our portfolio company AIcoustics).

But reliability and context-awareness limited how autonomous these systems could be in practice. Vertical-specific solutions consistently outperformed general-purpose assistants. Consumers showed limited tolerance for poorly contextualised or overly proactive AI behaviour.

The "life-log" hype of 2025 faded. The truth many realised is that most of life isn't worth recording, so many always-on wearables will struggle with PMF, likely replaced by vertical-specific solutions.

The next interface likely isn’t "AI recording everything" but ambient AI operating in constrained domains.

The 2026 Outlook: Expect fewer "AI everywhere" experiments and more focused deployments where AI operates quietly and reliably in the background. Autonomy will increase, but only within constrained domains with clear boundaries. The winners design for restraint and context, proving the most powerful AI is the one you don't have to talk to.

3. Physical AI: from buzzword to infrastructure

Last year we predicted: "Physical AI" would become the new buzzword as world simulation became AI's next grand challenge.

What happened: We were right about the buzzword - Google announced a new team to work on AI models that simulate the physical world, NVIDIA unveiled Cosmos trained on 20 million hours of video, and the funding frenzy followed. General Intuition secured one of the largest seed rounds ever at $133.7M in November, Field AI hit a $2B valuation, renowned AI scientist Yann LeCun launched Advanced Machine Intelligence (AMI) in December, reportedly seeking over $5 billion and just last week, Skild AI raised a $1.4 billion Series C led by SoftBank.

But in 2026, the first-mover advantage for general-purpose "robot brains" evaporated. With foundation models from NVIDIA, Physical Intelligence, and OpenAI becoming ubiquitous, a robot's ability to "see and move" might just be a commodity you buy via an API.

Because the "brain" is now a commodity, alpha has moved to whoever can deploy, maintain, and scale hardware most efficiently.

The companies best positioned might not just be the ones raising $1B+ for world models - they'll include industrial incumbents with existing manufacturing footprints. For example, FANUC does $6B annually in robotic arms and ABB's robotics division did $2.4B in 2024, both these companies already have the supply chains, customers, and distribution. When they can license a “better” model from Nvidia or Google, their existing advantages compound.

The 2026 outlook: For founders, your unfair advantage may need to be either deep proprietary tech (sim2real, foundation models, actuators) or hyper‑specific vertical insight. For VCs, this is a data point that exit paths can include “non‑obvious” acquirers adjacent to the core robotics space (e.g., automotive autonomy, chipmakers, industrial automation), and that value will cluster at the intersection of AI, hardware integration, and scaled manufacturing.

4. Robotics: now riding the next wave

Last year we predicted: A new wave of robotics startups would lead to a surge in investor interest.

What happened: We were right - VC investment rebounded sharply, with notable rounds including Figure AI ($1B+ Series C), Apptronik ($403M Series A), and OpenAI-backed 1X entered talks in September 2025 to raise up to $1 billion dollars.

However, in 2025, the majority of capital deployed went into the same three ideas: robot brain, robot training, and humanoids. But as the foundational models discussed above commoditise, alpha moved to the fringe.

At FOV, we made our first forays into robotics with two, so-far unannounced, rounds.

We see that many of the most successful deployments are still vertical-focused. Soft-robotic grippers for agriculture; Quadruped inspectors for oil rigs like Anybotics; Modular appendage-only AI for surgical bays. The robots currently making money solve highly specific tasks in environments where reliability beats generality enough times.

We're also seeing more deployments than ever before, particularly in China where manufacturers are moving aggressively into industrial robots, humanoids, and autonomous systems at scale. This has triggered increased Western focus on manufacturing sovereignty and supply chain resilience, driving more capital into domestic robotics - particularly for defence applications.

The 2026 outlook: Expect the paradox to intensify. Hype and funding will concentrate in humanoids and world models, but the best returns will come from vertical applications that solve specific problems exceptionally well.

5. VR & Mixed Reality: a year to recalibrate

Last year we predicted: VR's long march to mainstream adoption would continue through mixed reality, shaped by platform competition between Apple and Meta.

What happened: The march continued, but several setbacks signal a wintry year for VR - best categorised as a year of transition rather than category death. The mainstream narrative has cooled.

We didn't make any new VR investments in 2025 and will look at new opportunities very selectively.

As predicted, Vision Pro only got minor upgrades, with a next-gen (or cheaper) model unlikely until 2027. Google re-entered with AndroidXR powering a new Samsung headset, but it wasn't the game-changer hoped for. Meta just announced layoffs in Reality Labs content teams - a necessary reset after overpriming the pump.

The press narrative that "Meta is abandoning VR for AI" is overstated. Content spend is slowing, not usage. Anecdotally, VR engagement rose again over the holiday period and we predict Meta will expand the Quest ecosystem with a lighter headset later this year for broader lean-back audiences. Valve's 'Steam Frame' headset set for 2026 release should also do for VR what Steam Deck did for handhelds, solidifying the core gaming audience.

But there's two massive undercurrents:

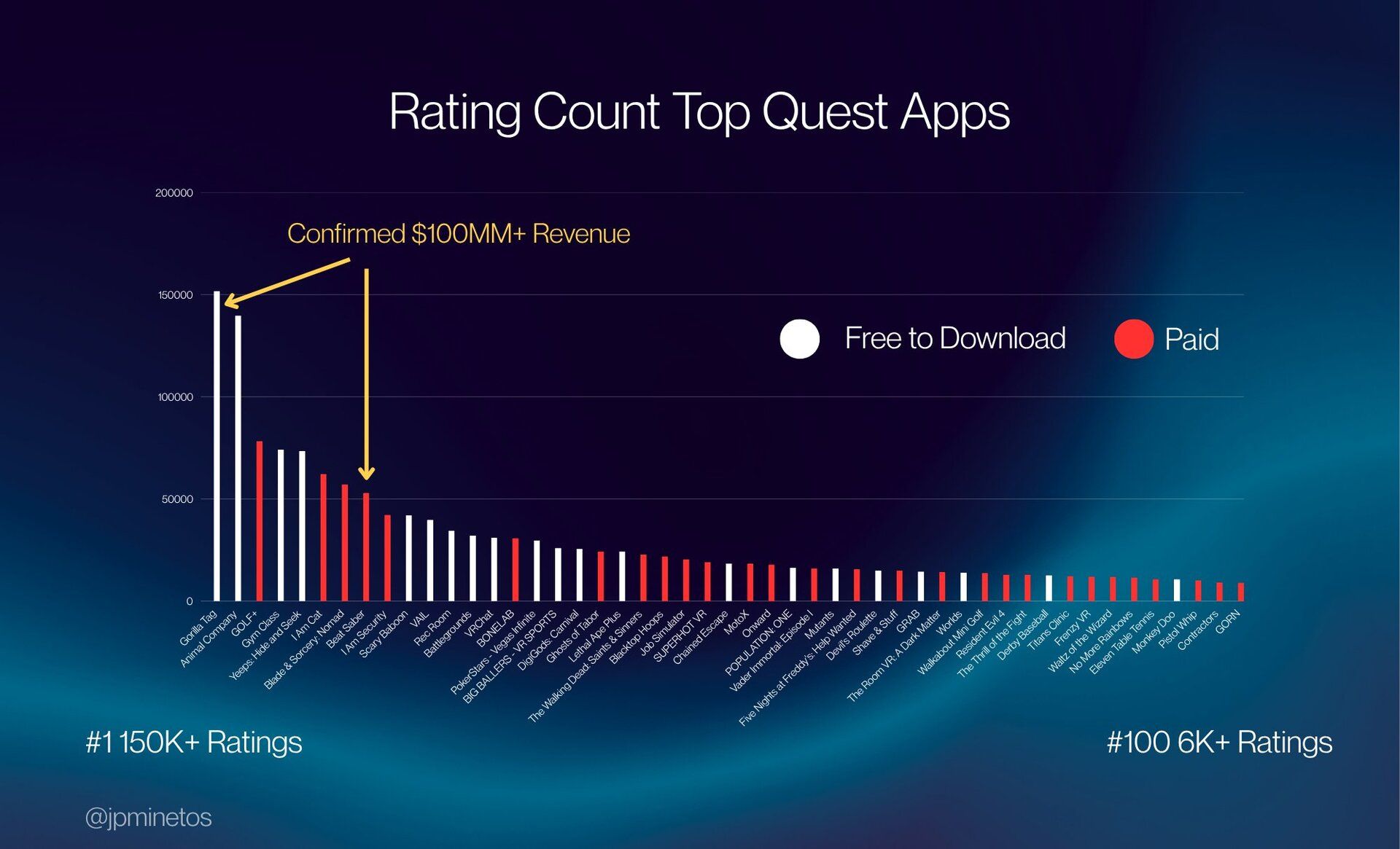

First, top-decile indie studios are printing money. Several, off the back of Gorilla Tag’s success, are nearing $100M in revenue and 10M players with their playbook of low-budget viral game mechanics that attract social media native audiences. Any new startups in this space need to prove they can develop products and iterate quickly with lean teams, leveraging social media to build community and user acquisition without over-relying on platform support.

Second, VR teleoperation is becoming a real business. Across hospitals, factories, and logistics hubs, humans increasingly "possess" robots via headsets to resolve edge cases. One operator supervises dozens of machines. Surgeons work remotely. Hazardous maintenance avoids human entry. Autonomous vehicles hand off complex maneuvers to remote pilots.

Platforms like Formant (Series B) and Viam (Series C) provide the fleet backbone. While startups like Extend and Sunday Robotics push low-latency control and learning at scale. This is becoming a high-ROI way to extend human skill across distance, risk, and labor constraints - while gathering valuable data for generalized AI models that take us closer to full automation.

The 2026 Outlook: Mainstream B2C/B2B hype is cooling, but alpha is in these two lanes. We're watching them closely.

6. Gaming Tech: underpinning the simulation stack

Last year we predicted: Gaming tech would expand beyond entertainment into core infrastructure.

What happened: We were right, but the shift was even more fundamental than expected. In 2025, we saw a "Simulation-First" approach solidify across every major sector. Anduril leverages game engines for high-stakes defence simulations (their first acquisition was a gaming company). Tesla creates virtual worlds to stress-test autonomous systems before they hit the road. Beyond heavy industry, BMW normalised AR in heads-up displays, and Matterport turned 3D walkthroughs from a luxury into a real estate standard.

The bottleneck shifted. It's no longer the engine itself - but the accessibility of content creation and data capture.

AI-powered creation tools like FOV portfolio companies Scenario and Move.ai are already being adopted by game studios as first movers to push creative boundaries. Meanwhile, 3D capture pipelines improved rapidly through techniques like gaussian splatting and image diffusion models, making it exponentially easier to scan assets and generate environments. FOV portfolio company M-XR exemplifies this shift, while companies like Graswald and Aino apply these techniques to unlock e-commerce and other verticals.

The final piece of gaming's move into industry is AI NPCs using autonomous agents and LLMs, creating sophisticated applications from soft skills training to healthcare to collaborative learning.

The 2026 Outlook: If you can simulate it in a game engine, you can scale it in the real world. We're actively investing here as the content creation bottleneck dissolves.

If you're building in any of these areas, we'd love to hear from you. While this list captures our current thinking, we're always excited to be proven wrong by founders seeing around corners we haven't yet turned. And no doubt we’ll continue to revisit this piece through the year.

Get in touch at www.fov.ventures