FOV Ventures: Look Ahead

Where we'll invest in 2023

In our last post, we took a pause for breath and reflected on 2022, a busy inaugural year for FOV Ventures. In this new post we wanted to spend some time outlining the trends and areas that we'll be focused on for 2023.

It's worth noting the areas that we highlight are most top of mind right now and don't necessarily represent an exhaustive list. And ultimately, we'll gravitate to wherever the smartest founders take us. So if you're one of these then please get in touch and surprise us! Reach out through our website or LinkedIn.

The inevitable hype cycle

When we launched the fund last year, we set out our general thesis and believe that the Metaverse opportunity spans over a decade, not just quarters or years. And with any new breakout area of technology we'll see a number of hype cycles. As a long term fund our job is to invest consistently throughout these cycles, but be able to identify the right teams, tackling the right problems, at the right time. So let's address the hype first, before moving on to some of the areas we think are interesting right now.

It's undeniable that the most recent Metaverse hype reached a crescendo in Q4 2021 and continued into a large chunk of 2022. Overall this was a huge net positive. Talent and capital flowed into the space, general themes went from being niche to something you'd read about in mainstream press. New experiments were able to happen. But as with any boom cycle, it came with some downsides. Thankfully, as we go into 2023, we believe most of that noise will fade into the background and it will be easier to get back to focusing on the fundamentals.

According to Sifted and Dealroom, Metaverse investments were up last year to $666m, over 4 times 2021's figure of $143m. Additional data from Crunchbase (which only covers some sub-categories within the Metaverse) suggests that investment slowed quarter on quarter — as did venture in general. We expect that to continue in 2023, especially given the general headwinds in VC that include worsening macro conditions and recent specific shocks in the late-stage and crypto markets.

However, as FOV Ventures, our pace of investment has remained consistent since launch and we expect more of the same in 2023. Founders won't have it easy this year and we'll be paying much more attention to entry valuations. We'll also be closely monitoring our portfolio cash runway and the likely funding environment our founders will face as and when they go back out to raise. But with the mercenaries and the tourists fading away, the signal to noise ratio will increase and we expect a flight to quality ie. high conviction teams building meaningful products. There's still plenty of dry powder from funds like FOV Ventures for the missionaries and the builders that come with strong and validated ideas. As we concluded in our last post... now is the time to build!!

So what are some new areas that we want to spend more time with in 2023?

Generative AI

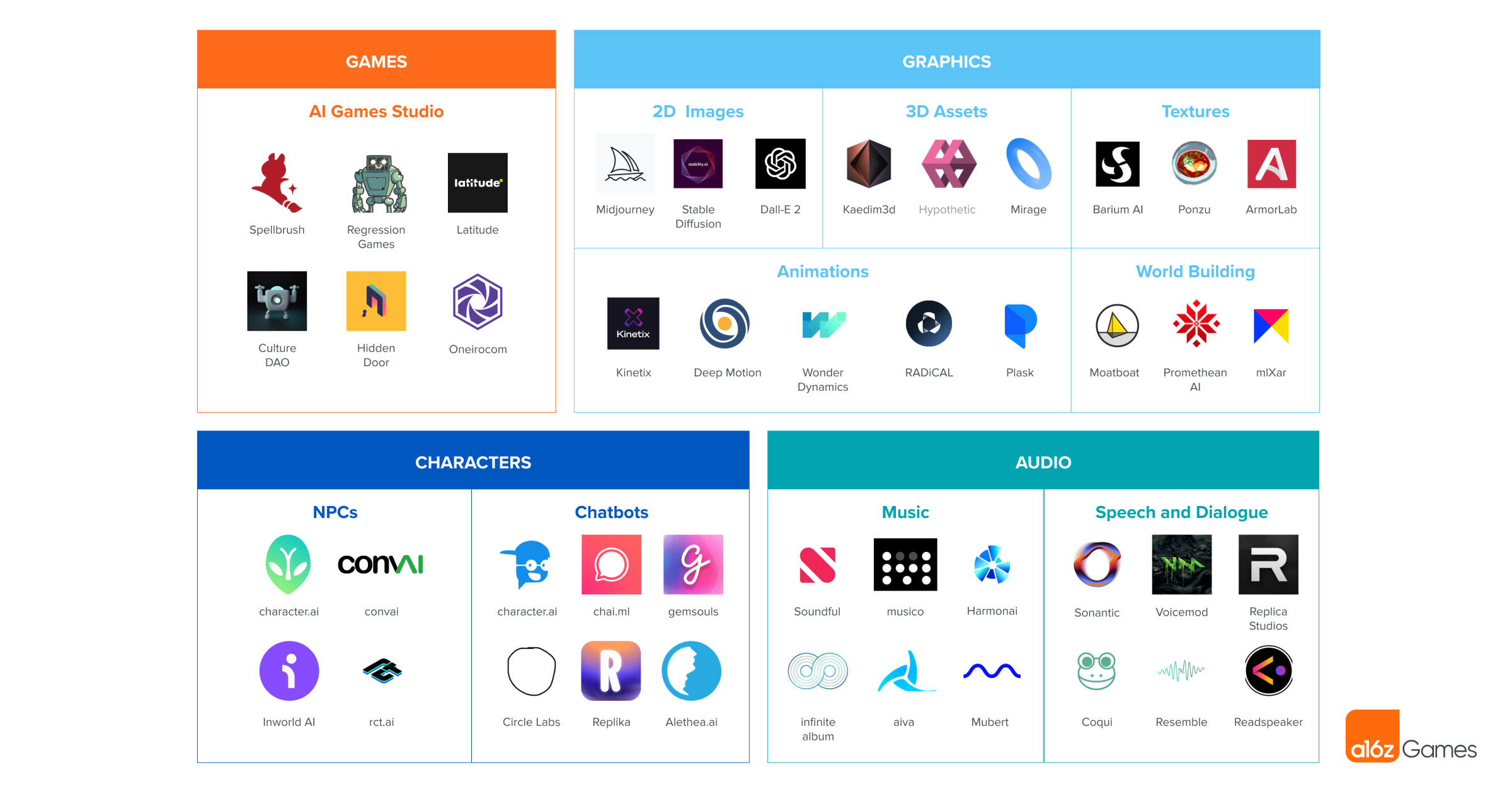

It's difficult to look at social media, or even mainstream news, without seeing a new post or comment piece about generative AI. With so many different applications from customer support to drug discovery to 3D asset generation, it will no doubt be THE VC buzzword of 2023. But what is Generative AI? In case you've been under a rock this past 6 months, let's get meta and leave it to ChatGPT to explain 👇

ChatGPT Metaverse

Impressive, huh? Add to that...

Text-to-image services like Midjourney and Dall-E 2

Text-to-3D object startups like Kaedim, Alphaar and Nvidia's Magic3D

Generative 3D animations and behaviours from startups like Move.ai and Anything.World

Character and avatar intelligence from startups like Inworld, Carter and Virtual Beings

Artificial voices from startups like VoiceMod and Resemble.ai

The ability to capture surfaces materials and generatively reproduce real world objects using techniques being developed by M-XR

Next-gen virtual production tools from startups like Simulon and Skyglass

Now imagine my kids typing in a prompt into a Discord chat and having it generate a virtual world, that looks like a photo-real futuristic NYC, populated with a cast of different NPC characters and automagically animating a virtual production of a car chase. We're not as far off from that reality as you might think.

In the same way that the creation and sharing of various types of media were democratized during the web 2.0 era -- writing (Wordpress), photos (Flickr), video (YouTube) and audio (SoundCloud), the creation and sharing of more immersive forms of media will be revolutionised in the Metaverse era — animation, games, Hollywood productions, virtual worlds and so on.

As well as the tools and the platforms, there's a strong chance we'll need startups making new browsers (Ray Browser), new game engines that are built from the ground up with community, collaboration and these new creation tools in mind (Dims), new forms of search, discovery, moderation and IP protection (let us know if you're working on this!)... and much more. It's still hard to evaluate where the most value will accrue in this new era and whether it's startups or incumbents that will take the biggest slice of the pie, but anyone building in this area right now is riding the wave of a revolutionary shift in the way we think about content creation.

We plan to write a deeper dive on this topic in the near future, but in the meantime here are a couple of other great reads. And if you're building in this space, we'd love to hear from you!

The Metaverse at work

When people think about the Metaverse they often think of the consumer use cases first; ie. how it's changing the way we hang out with friends, play games or re-imagine media and entertainment. But for us, the Metaverse is built upon a set of technological building blocks that are also changing the way we work and even what jobs we'll do in the future.

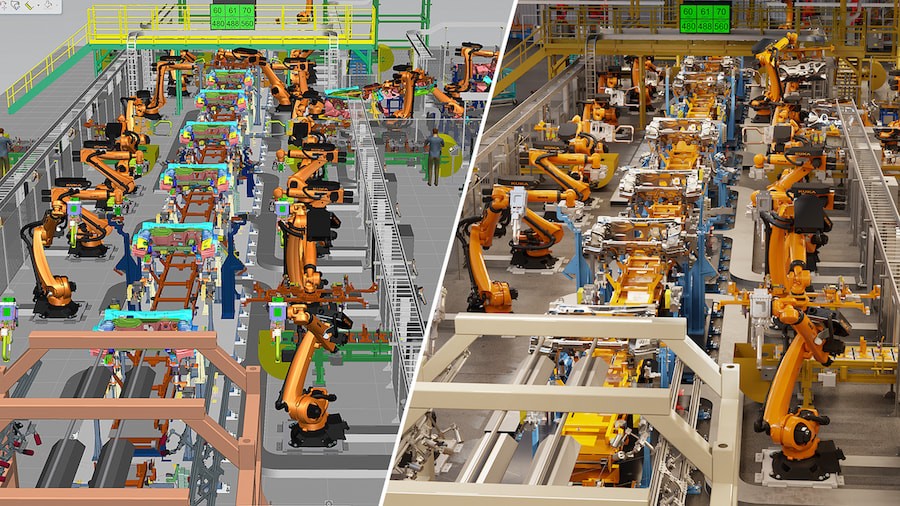

Whilst Zuckerberg's Meta is busy focused on re-inventing meetings with virtual presence, we also think a lot about what Microsoft's Satya Nadella and Nvidia's Jensen Huang refer to as the Enterprise Metaverse. Others like David Ripert (from FOV's Edge Network) and the MIT Technology Review are also talk eloquently about the 'Industrial Metaverse'. However you define it, the work-related Metaverse should not be overlooked and has the potential to deliver considerable value alongside consumer related applications.

The Enterprise & Industrial Metaverse could outstrip the value of the Consumer Metaverse

Use cases that Petri & I have invested in prior to FOV Ventures, include Training (from soft skills to healthy & safety to surgical training), Healthcare (from mental health to rehabilitation) as well as applications such as Visualisation, Digital Twins and Collaboration for the oil & gas industries. There is now proven ROI in most cases and we still believe that technologies such as mixed reality and AR will deliver tangible value in the workplace first, where you're paid to wear a headset to augment your daily tasks.

But as well as the heavier B2B applications we're particularly interested to see new cases that range from product visualisation and e-commerce, to productivity, to areas like interior design. I don't think we're far away from a reality where it will be commonplace to use a lidar enabled phone to create a digital twin of their front room and then effectively do all of their design and purchasing decisions in a fully virtual environment.

There is a huge surface area to invest in here and again we hope to do some more writing in the near future to clarify our thinking on what areas are the most appealing at the pre-seed and seed stage. But overall, in 2023, we'd like to add more work-related startups to the FOV portfolio.

Consumer VR

Swinging all the way back to the consumer side of things, one area that we looked at closely last year was consumer VR, especially VR gaming. We didn't find as many opportunities as we were hoping to in 2022 and still haven't done any pure play VR investments as FOV Ventures. However, we were thrilled to invest in Virtex, the virtual stadium for viewing e-sports and other entertainment which is cross-platform incl. VR.

In 2023 we'd like to do more here, and it feels like a good time to do so. Since the initial hype of ca. 2016, consumer VR has traditionally not been a fashionable category for most VC's. Last year Meta crossed the 10m headset threshold, with numbers expected to grow past 20m by the end of 2023 (overall headset install base sits close to 30m). At Connect, Meta announced it had done $1.5bn in revenue to date, with a $60m monthly average and one third of apps making $1m. Some studios like Ramen VR made the $1m figure in just the first 24hrs of the launch of their VR MMORPG Zenith.

These numbers are still too low to turn heads for many of the traditional AAA game studios and major publishers, who often have 9 figure production budgets for new titles. But it is an amazing baseline for any new developer who can carve out space for itself on the official Quest store and not face as much competition or UA spend as you would in the crowded mobile market. And whilst App Lab and SideQuest both serve as a great testing ground for ideas, building community and fast iteration, competition is also heating up with Bytedance's continued investment in consumer VR market with Pico. Lastly, the long awaited launch of Sony's PSVR2 will provide another boost to VR gaming, alongside Meta's expected Quest 3, which should be available ahead of Xmas '23.

Quest store revenue hits $1.5bn

We're also interested in consumer VR categories including wellness, non-enterprise productivity and other casual/social uses cases outside of pure gaming. This is where I think there are some real gems to find, especially in uses cases that suddenly become addressable as new form factors and a larger install base become reality. And if the rumoured entrance of Apple into the market in 2023 really does happen, then I think it's a safe bet to say that they'll also be interested in the lifestyle, fitness and media use cases that sit alongside gaming. If you're building something new in VR gaming then we'd love to hear from you.

Get in touch!

We've covered some fairly broad areas in our three sections above. Suffice to say there are other things that we're excited about for 2023. So this isn't an exhaustive list. We could have written more about Mixed Reality and why we think it will unlock new use cases and act as an interesting stepping stone for the AR startups of the future. We could have written about why we think great entrepreneurs need to find more specific needs to meet with virtual worlds, beyond generic events and displaying NFT art. We could have talked about the fact that 2022 was arguably the year that traditional social media died and how the Metaverse could have a large role to play in the evolution of social. We could have talked more about which uses cases we think could still thrive post-FTX at intersection of Metaverse and Web3. And last but not least we could have written about why we need to fund more diverse founders and what we plan to do to pro-actively accelerate more investments there. But we'll leave those details to future blog posts and look forward to hearing from a new wave of founders educating us with another 500+ ideas in 2023!